Scalping tips

You have decided you adopt a scalping trading style. Here are scalping tips to keep in mind.

Before starting to scalp:

1) Close down all programs running in the background. If your press ctr+alt+del the task monitor open up and it will tell you what programs are running. You can kill these from this window.

2) Ensure your connection is stable and fast. For those using wireless, it would be even better if you are connected with your cable directly into the router.

3) Ensure you are using a broker that does not delay the execution, as execution is fundamental in scalping. At times you will need to get in and out of a price in less than 30 seconds.

Scalping Tips:

1) Execution

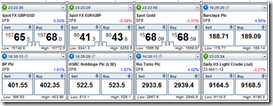

Get used to your spread betting brokers trading platform. There are platforms you can customize so that you can organize your charts, your current profit and loss and your order execution buttons so that you have quick access to entering and exiting an order.

Practice a little before trading Big. Most of scalpers loose money in the first month due to execution errors.

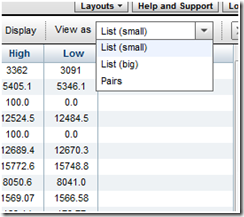

here is an example of enlarging the trading buttons in :

2) Controlling Your Costs

First of all when Scalping, it is important that you keep costs under control. Scalping is all about taking or giving small profits. If you start letting your costs run these could eat up your profits. What I mean by costs, is not being decisive or convinced on a certain about a trade and you enter a trade to quickly close it. In this situation you have paid the spread. These little costs can add up.

3) Know the market sentiment and trend

You must be prepared when entering your trade. Do your homework before trading; know the general sentiment of the market. Know the direction of the main trend and of the medium term trend. At the beginning it is advisable to stick to the trend. Once you get the necessary experience you can also counter trend.

Below are Forex Spread betting examples of an hourly graph and a 5 minute graph. As you can see in the hourly, you can see the big picture.

*if you want to read more on Forex spread betting example

4) Emotions – Controlling your urge to overtrade

This is the hardest part in scalping but also applies to all styles of trading. Do not over trade. Many traders that start off and maybe never make it, is because they overtrade in the beginning and they start making a lot of little losses to soon find their account so low or in the red that they cannot be impartial in their trading. Therefore it is essential that from the beginning you take control of your trading urges. When you start off scalping you can also play it safe, that is, even if you miss a couple of trades do not feel you are missing out, but see it as market experience. You are currently learning. The market won’t go anywhere.

5) Emotions – Discipline to be patient and stick to your trading Plan

Choose a strategy that suites you and your trading hours. Write it on paper and stick to it. With time you will perfect it but at the beginning this will help you be disciplined to stick to rules. Ensure that the trading strategy you adopt at the beginning of your scalping or spread betting career has a high probability and positive expectancy. Even if at the beginning this means more sitting on the side lines, well being more patient and taking fewer trades. If you trade in the evening you might end up trading only 3 to 4 times.

6) Study or have an understanding of basic technical analysis

It is also important to have a basic knowledge or understanding of technical analysis. The pros and cons of using various indicators; what are their strengths and weaknesses. This will give you a good understanding of your trading system and when it will and will not work.

7) Adjust to market conditions/ Volatility

If volatility increases you need to adjust the size of your trades to cater more for these volatile moves. This is why it is important you know well the average range of the markets you are trading in that time frame. So in case the market starts moving twice as much as the usual you can halve your sizes.

When scalping, volatility is also necessary. Trading a market that is very quiet or dead will not give you much opportunity. Many spread betters resort to Forex as there is movement in the Forex market. Scalping is about trading little and lots. Taking lots of profits.

8 ) Last rule – Don’t hang onto losers – Stick to your trading style.

If you are scalping you must have no open positions overnight. Don’t hang onto loosing trades waiting for them to recover. Learn to take a loss. This is a numbers game. It is fundamental that your winning odds are greater than your loosing odds.

I hope these scalping tips have helped. click here to go back to the top Scalping Tips

or